FinLitFuture$ and the Financial Security of Future Generations

Welcome to the latest Viewpoint, the official publication of the Retirement Advisor Council! In this issue, we will discuss our groundbreaking FinLitFuture$ initiative and how you can join us in promoting the future financial security of children.

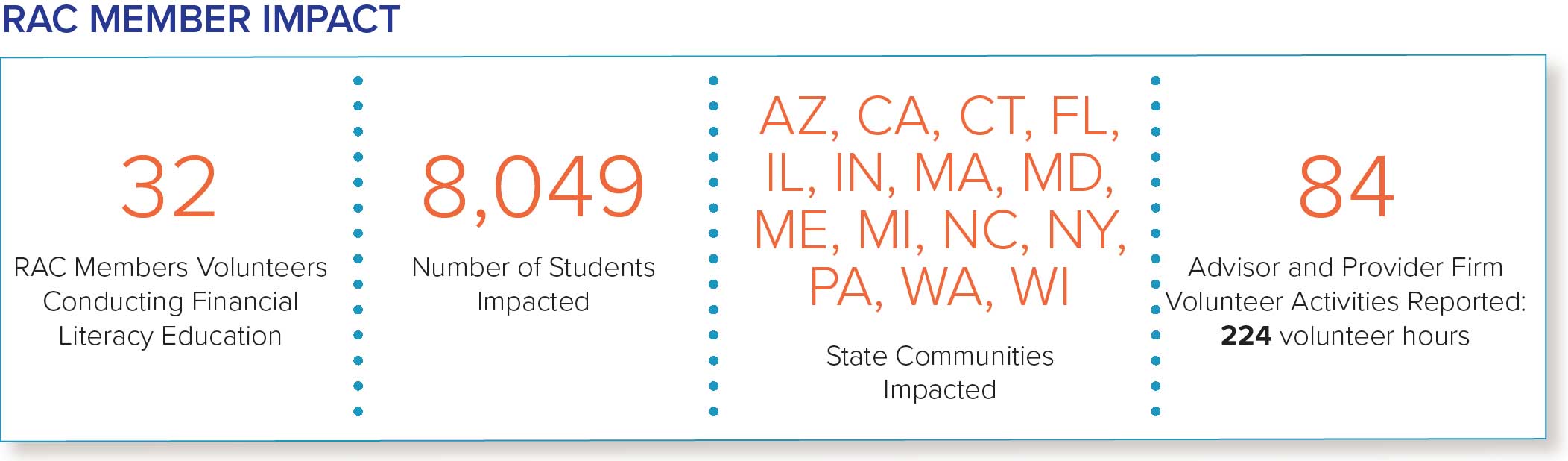

FinLitFuture$ is a collaborative initiative founded and developed by the Retirement Advisor Council. The Council has a specific purpose; to support efforts of all Americans to achieve financial independence. Beginning with the ultimate goal in mind, we believe that the way to fuel the financial knowledge of America’s future leaders is by advancing financial education for its youth. FinLitFuture$ is fiercely dedicated to supporting, organizing, and inspiring the collective volunteer and advocacy efforts of financial advisors, service providers, asset managers, and retirement industry associates who share a commitment to advancing financial education in schools and community programs.

The need for financial literacy education in our nation’s schools is exploding. Twenty-nine states now require a financial literacy course in high school, up from just eight states in 2020. An amazing 16 states are currently in the implementation stages of such requirements. Notably, the average implementation phase for states to meet their mandates for financial literacy course offerings is 2-3 years. Simply put, this means that exponentially more classes on financial literacy will be taught in schools in the next decade than in the previous one.

Students want to learn about finances. According to a survey conducted by Junior Achievement and Big Village, 68% of teens would eagerly enroll in a financial literacy course if offered, but only 31% report having access to such courses at their schools. Per the current state implementation schedule, that access should dramatically increase in the next few years.

The students of today will become the wealth-builders of tomorrow. According to Junior Achievement, young adults aged 18-29 are two times more likely to be financial independent and save for retirement. We also know that, due to the magic that is compound earnings, these statistics all add up to future generations not having to worry about financial stress!

This next generation needs our help to get there. Fortunately, getting involved is a snap! Just check out these simple ways that you can get started:

1) Promote — go to our FinLitFuture$ LinkedIn page or our website and simply follow the page, comment on our posts/blog entries or share them—that’s it! By doing this, you will spread the word to countless others as to how they can get involved in local youth financial literacy education or advocacy initiatives. As an industry we have a big opportunity to leverage the collective power of our network, by inviting our colleagues, partners, and clients to get involved in supporting this important endeavor.

2) Participate — to take your involvement one step further, it is so easy to teach your first class to kids; just sign up to volunteer and you’re on your way! There are several resources on our website to help you along. Don’t want to teach a class just yet? Organizations such as Junior Achievement, Council for Economic Education, and Next Gen Personal Finance offer a variety of ways that you can assist. Additionally, you will find free down-loadable grade-specific financial literacy presentations and resources through FDIC Money Smarts and VISA Practical Money Matters programs on the FinLitFuture$ website (these resources are available in English and Spanish). Note that some employers will even provide you with paid volunteer hours for efforts such as this. Of course, once you’ve volunteered, feel free to share your own social media post about it!

3) Perfect — We find that, once you’ve taught one class, the experience is so rewarding you’ll want to teach many more! If you’ve gotten to that level, contact us so that we can share your story, as this will cause even more people to get involved! Check out the case studies in this Viewpoint of how others have made a difference in the lives of kids.

So, what are you waiting for? Get started with FinLitFuture$ today!

Award-winning financial literacy volunteer efforts

Award-winning financial literacy volunteer efforts

Joshua Chase, CFP, CPFA, Financial Advisor from BGA Retirement Advisors in Maine has been a dedicated financial literacy education volunteer through his efforts in partnership with Junior Achievement Maine. Over the past few years, Josh has impacted the lives of 200+ high school students. In 2024, he was presented the Student Impact Award by JA Maine. Josh shared “As corny as this sounds, I think the Student Impact Award should be called the Volunteer Impact Award, as I (the volunteer) was impacted by the students every time I stepped into a classroom. Seeing Maine’s teachers and students in action makes it easy to stay optimistic about the future of Maine’s workforce.”

Financial literacy efforts reward the students and the volunteers!

By Paula Hendrickson, CFP®, C(k)P™, Director Retirement Plan Consulting and Retirement Advisor Council Member

I worked for an organization that was passionate about financial literacy for elementary through high school aged children. We created a relationship with Junior Achievement and committed to a specific amount of time to be donated by our employees each year. I volunteered for three years in a row to teach a classroom of children; third, fifth and eighth grades. Junior Achievement does a great job of putting together curriculum that is age appropriate and keep the children engaged and learning about finances. From creating efficiencies with manufacturing – an assembly line putting together ball point pens – balancing a checkbook, creating a budget, drafting a business plan to understanding world economies.

It was so rewarding and the letters that I received following that day were so heartwarming. It gave me as much of a sense of accomplishment as winning a large retirement engagement.

Credit for Life

By Thomas E. Hoffman AIF®, CFS®

KAF Financial, Retirement Advisor Council Member

Credit for Life began as a personal endeavor for me. When my son Greg, now 30, was a senior at Boston College High School in 2012, I joined the initial Credit for Life Committee. Recognizing the need for financial education in schools, we created an initiative that has since evolved significantly. Credit for Life is part of the Student Financial Education Initiative, Inc. (SFEI), a 501(c)(3) organization in Massachusetts. SFEI promotes experiential financial education in local schools and communities, supported by community banks and nonprofit foundations. They operate the online platform www.creditforlife.org, offering tools and modules for virtual or in-person budgeting and financial learning.

Originally, we conducted a morning session for the entire senior class at Boston College High, with class sizes ranging from 280 to 325 students. Held in the gym, each student goes through a budget-making process, receiving a packet outlining their annual income, credit score, credit card balance, student loan balance, and tax deductions. They must then sign up for required categories and consult with a credit counselor when facing budget issues. Many students realized the practicality of switching from a $700-a-month BMW to a $235-a-month VW! The program is supported by about 75 volunteers, including parents, alumni, and bankers. Due to student feedback, we expanded to include afternoon sessions,

where two other committee members and I host 45-minute classes. The senior class is divided into three groups that rotate through sessions covering the Ten Commandments of finances, basic investing terms, and a deep dive into credit cards, student loans, and college preparedness. Using my own children’s experiences as examples creates an immediate connection with the students. I’ve also presented at other schools, such as Notre Dame Academy, an all-girls Catholic school in Hingham, where I give a 30-minute presentation to about 125 seniors. I cover the Rule of 72, compounding, long-term investing, and basic credit card pros and cons. The senior class of over 300 is usually 90% college-bound, and I cover paycheck analysis, basic tax filing, credit cards, auto loans, and more. In the spring of 2023, I taught two sections of a business teacher’s class, which included students from grades 9-12. The curriculum was more sophisticated, covering both the positive and negative aspects of compounding and reviewing the Investment Company of America guide. Lastly, I’ve taught two classes a year for three years at Cristo Rey High School in Boston’s Savin Hill. These students are disadvantaged and 100% go on to college as first-time attendees in their families. My journey with Credit for Life has been incredibly rewarding. It’s amazing to see these young people embrace financial knowledge and prepare to apply it in their adult lives.

where two other committee members and I host 45-minute classes. The senior class is divided into three groups that rotate through sessions covering the Ten Commandments of finances, basic investing terms, and a deep dive into credit cards, student loans, and college preparedness. Using my own children’s experiences as examples creates an immediate connection with the students. I’ve also presented at other schools, such as Notre Dame Academy, an all-girls Catholic school in Hingham, where I give a 30-minute presentation to about 125 seniors. I cover the Rule of 72, compounding, long-term investing, and basic credit card pros and cons. The senior class of over 300 is usually 90% college-bound, and I cover paycheck analysis, basic tax filing, credit cards, auto loans, and more. In the spring of 2023, I taught two sections of a business teacher’s class, which included students from grades 9-12. The curriculum was more sophisticated, covering both the positive and negative aspects of compounding and reviewing the Investment Company of America guide. Lastly, I’ve taught two classes a year for three years at Cristo Rey High School in Boston’s Savin Hill. These students are disadvantaged and 100% go on to college as first-time attendees in their families. My journey with Credit for Life has been incredibly rewarding. It’s amazing to see these young people embrace financial knowledge and prepare to apply it in their adult lives.

Leveraging the Collective

Power of our Networks

As an industry, we have a power to leverage our “connective tissue” and broad networks to make meaningful difference through group-led financial literacy initiatives. Regional FinLitFuture$ initiatives were coordinated in Hartford, Boston, and Philadelphia in 2024 in partnership with non-profits We Inspire, Promote, Network (WIPN), Junior Achievement, Council for Economic Education, and Financial Scholars.

Notably, RAC members and sponsoring firms, including Lisa Buffington of Marsh McLennan Agency, American Century, Amundi and Principal supported 2 Junior Achievement Stock Market Challenges in 2024, that impacted over 330 students from six high schools in Connecticut.

WIPN members and sponsoring firms including Fidelity, MFS, Principal and American Century supported financial literacy education fundraising breakfast events for Junior Achievement and Council for Economic Education in Hartford and Boston providing resources to over 800 high school students.

And the RAC hosted its first regional FinLitFuture$ Roundtable event in Pennsylvania under the leadership of Derek Fiorenza of Summit Group Financial Partners and hosted by Lincoln Financial Group, where community non-profit partners Financial Scholars and Junior Achievement presented their financial literacy programs to a group of local financial advisors and partners in the retirement industry. These initiatives highlighted above represent perfect examples of collaboration that can be modeled by others across the retirement industry to be implemented in their communities.

Lisa Buffington, Marsh McLennan Agency, Bobby Allen, American Century, and Chris Bitello, Amundi, pictured with students from the Stock Market Challenge

About The Council

The Council advocates for successful qualified plan and participant retirement outcomes through the collaborative efforts of experienced, qualified retirement plan advisors, investment firms and asset managers, and defined contribution plan service providers.

Retirement Advisor Council is a brand of EACH Enterprise, LLC

Eric Henon, Executive Director

Retirement Advisor Council

(860) 254-5046

ehenon@retirementadvisor.us

This material is intended for an audience of financial advisors and ERISA plan fiduciaries residing in the United States. It is not intended for plan participants or for the general public.

The sole purpose of this material is to inform, and it in no way is intended to be an offer or solicitation to purchase or sell any security, other investment, or service, or to attract any funds or deposits. This article does not consider the actual or desired investment objectives, goals, strategies, guidelines, or factual circumstances of any investor in any fund(s). Before making any investment, each investor should carefully consider the risks associated with any investment, and make a determination based upon their own particular circumstances, that the investment is consistent with their investment objectives and risk tolerance.

Retirement plans are complex, and the federal and state laws or regulations on which they are based vary for each type of plan and are subject to change. In addition, some products, investment vehicles, and services may not be available or appropriate in all workplace retirement plans.

Investments and concepts mentioned in this document may not be appropriate for all clients. Retirement plan sponsors and plan administrators should consult their investment, tax, and legal advisors and carefully consider all of the benefits, risks, and costs associated with a plan (a) before adopting any plan, (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a retirement plan or account.

The Retirement Advisor Council does not sell securities, does not provide investment advice, legal advice, or tax advice. The Retirement Advisor Council is not an ERISA 3(16) plan fiduciary.